Base salary for financial advisors in banks is $78,414 annually. Additionally, they can earn additional income through commissions. ZipRecruiter calculates salaries based on job postings and third party data sources. The average salary for financial advisors can be higher or lower than that. Additionally, some advisors may earn more than the national average. Some jobs offer additional benefits such as retirement savings or bonuses.

Average base salary

The average salary for a financial advisor is $65,000. It varies from one state to another. The top-paying state for a financial advisor in May 2017 was Wall Street, New York, with a mean annual wage of $166,100. California was second with $141,100 followed by Connecticut, New Jersey (D.C.) and Maine. Each had a base salary of $20,870 more than the national average.

Base salary based on experience

The average annual salary for a financial advisor is $60,000 to $110,000. But the range of compensation can be much higher than that. Pay is largely determined by the amount of experience and client volume. The average service advisor is paid $25,000 less per year. Lead advisors make almost $160,000 per year while Practicing Partners make almost twice that amount. Before recommending any investment, a financial planner should be familiar with all applicable tax laws.

Base salary by state

Bank Financial Advisors make an average of $52,530 per year. This varies depending on the location. The median income for an advisor in southeast Nebraska, at $52,530, is lower than the mean annual salary in many other states. Depending on the role, a financial advisor may also be called a Medical Advisor, Independent Financial Analyst, or Senior Financial Advisor. In some states, the base pay for a bank financial advisor varies greatly by region and industry.

Commissions based compensation

A financial advisor who receives compensation based on commissions may not be the best option for all clients. Commissions are important but they should not be the only source of financial advisors' compensation. In some cases the compensation might include other types of payments such as soft-dollar fee, referral fees and surrender charges for investment products. Advisors should also be able to talk about compensation with clients.

Compensation based on profit percentage structure

The compensation a financial adviser can earn will be largely dependent on his or her level of experience. However, the compensation a professional financial advisor earns will be affected by the size of his clients and how successful he or she is in developing his or her business. A top-quartile Service adviser would earn $25,000 more per year than the average Lead advisor. A top-quartile Practicing partner would also earn more than twice the average lead advisor.

FAQ

How to beat inflation with savings

Inflation is the rising prices of goods or services as a result of increased demand and decreased supply. Since the Industrial Revolution, when people started saving money, inflation was a problem. The government manages inflation by increasing interest rates and printing more currency (inflation). But, inflation can be stopped without you having to save any money.

For example, you can invest in foreign markets where inflation isn't nearly as big a factor. The other option is to invest your money in precious metals. Silver and gold are both examples of "real" investments, as their prices go up despite the dollar dropping. Investors who are concerned about inflation are also able to benefit from precious metals.

What is retirement planning?

Planning for retirement is an important aspect of financial planning. You can plan your retirement to ensure that you have a comfortable retirement.

Retirement planning means looking at all the options that are available to you. These include saving money for retirement, investing stocks and bonds and using life insurance.

Who Should Use a Wealth Management System?

Everyone who wishes to increase their wealth must understand the risks.

It is possible that people who are unfamiliar with investing may not fully understand the concept risk. As such, they could lose money due to poor investment choices.

It's the same for those already wealthy. Some may believe they have enough money that will last them a lifetime. But they might not realize that this isn’t always true. They could lose everything if their actions aren’t taken seriously.

As such, everyone needs to consider their own personal circumstances when deciding whether to use a wealth manager or not.

How to Begin Your Search for A Wealth Management Service

The following criteria should be considered when looking for a wealth manager service.

-

Proven track record

-

Is it based locally

-

Offers complimentary initial consultations

-

Provides ongoing support

-

Has a clear fee structure

-

Reputation is excellent

-

It's easy to reach us

-

Customer care available 24 hours a day

-

Offering a variety of products

-

Low fees

-

No hidden fees

-

Doesn't require large upfront deposits

-

A clear plan for your finances

-

Is transparent in how you manage your money

-

Makes it easy for you to ask questions

-

Have a good understanding of your current situation

-

Understanding your goals and objectives

-

Is willing to work with you regularly

-

Works within your budget

-

A good knowledge of the local market

-

Is willing to provide advice on how to make changes to your portfolio

-

Is ready to help you set realistic goals

What is risk management in investment administration?

Risk management is the art of managing risks through the assessment and mitigation of potential losses. It involves the identification, measurement, monitoring, and control of risks.

An integral part of any investment strategy is risk management. The goal of risk-management is to minimize the possibility of loss and maximize the return on investment.

The key elements of risk management are;

-

Identifying the sources of risk

-

Monitoring and measuring risk

-

Controlling the risk

-

How to manage the risk

Statistics

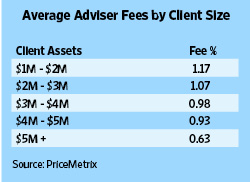

- A recent survey of financial advisors finds the median advisory fee (up to $1 million AUM) is just around 1%.1 (investopedia.com)

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

External Links

How To

How to invest when you are retired

Retirement allows people to retire comfortably, without having to work. How do they invest this money? There are many options. For example, you could sell your house and use the profit to buy shares in companies that you think will increase in value. Or you could take out life insurance and leave it to your children or grandchildren.

If you want your retirement fund to last longer, you might consider investing in real estate. Property prices tend to rise over time, so if you buy a home now, you might get a good return on your investment at some point in the future. If you're worried about inflation, then you could also look into buying gold coins. They do not lose value like other assets so are less likely to drop in value during times of economic uncertainty.